Hedge & Safe Haven Testing with HedgeSafeHaven

Jawad Shahzad

2025-11-02

getting-started.RmdHedge and Safe Haven Testning

The package/repo is developed to test hedge and safe haven hypotheses (Baur and McDermott 2010), estimate the hedge ratio, hedge effectiveness, and optimal portfolio weights (Basher and Sadorsky 2016), cross-quantilogram-based predictability (Han et al. 2016) and the conditional diversification benefits (Christoffersen et al. 2012, 2018).

Background & Motivation

The role of assets such as gold and bitcoin as potential hedges or safe havens for equity markets has attracted increasing scholarly attention (e.g., Ali et al. (2020); Shahzad et al. (2019); Shahzad et al. (2020); Mujtaba et al. (2024)) amid heightened global economic uncertainty, persistent inflationary pressures, and evolving monetary policy regimes.

Market Context (as of late 2025)

-

Gold has surged to record highs above

$4,000 per ounce, driven by central-bank purchases and

portfolio diversification away from fiat currencies.

(BeInCrypto, 2025) -

Bitcoin climbed above $110,000

amid U.S. dollar weakness and renewed “digital-gold” narratives.

(Forbes, 2025) - Short-term divergences have appeared — gold rallies while bitcoin

retreats — highlighting their differing safe-haven mechanisms.

(CoinDesk, 2025)

The HedgeSafeHaven package provides econometric tools to quantify such behaviors using regression-based safe-haven models, cross-quantile dependence, and conditional diversification benefits (CDB).

Example Workflow — Gold and Bitcoin

We illustrate how to use gold (GLD) and bitcoin (BTC) as potential hedges or safe havens for the U.S. stock market (S&P 500).

1️⃣ Hedge / Safe-Haven Classification

library(HedgeSafeHaven)

# Regression-based hedge/safe-haven estimation

# SP500 and Gold

data("hedgedata")

res_gld <- hedge_safehaven_bm10(hedgedata$SP, hedgedata$GLD)

print(res_gld)## Hedge Coefficient p_value

## 1 c0 0.04988263 0.06089549

## 2 0.10 -0.07209026 0.27142322

## 3 0.05 -0.11405518 0.01072091

## 4 0.01 0.03023066 0.56524296

# SP500 and Gold

res_btc <- hedge_safehaven_bm10(hedgedata$SP, hedgedata$BTC)

print(res_btc)## Hedge Coefficient p_value

## 1 c0 0.8844556 3.060991e-20

## 2 0.10 0.4617737 3.194434e-02

## 3 0.05 1.1166908 1.300167e-12

## 4 0.01 1.5372902 5.973991e-30

# Classification

classify_bm10(res_gld)## [1] "Selected asset is a not a hedge - safe haven for 5% ."

classify_bm10(res_btc)## [1] "Selected asset is a not a hedge - not a safe haven ."This classifies gold/bitcoin role as a hedge or safe haven relative to sp500 using the Baur and McDermott (2010) approach.

2️⃣ Hedge Effectiveness via DCC

# Hedging asset: Gold

res_gld <- hedge_effectiveness_dcc(hedgedata$SP, hedgedata$GLD)

print(res_gld)## beta_mean beta_min beta_max HE OPW

## 1 0.01634998 -0.8941619 1.532328 0.03604662 0.4852705

# Hedged asset: Bitcoin,

res_btc <- hedge_effectiveness_dcc(hedgedata$SP, hedgedata$BTC)

print(res_btc)## beta_mean beta_min beta_max HE OPW

## 1 0.06999591 -0.01849912 0.4599944 0.1095714 0.03016472This provides the summary of hedge ratios and the hedge effectiveness as in Basher and Sadorsky (2016).

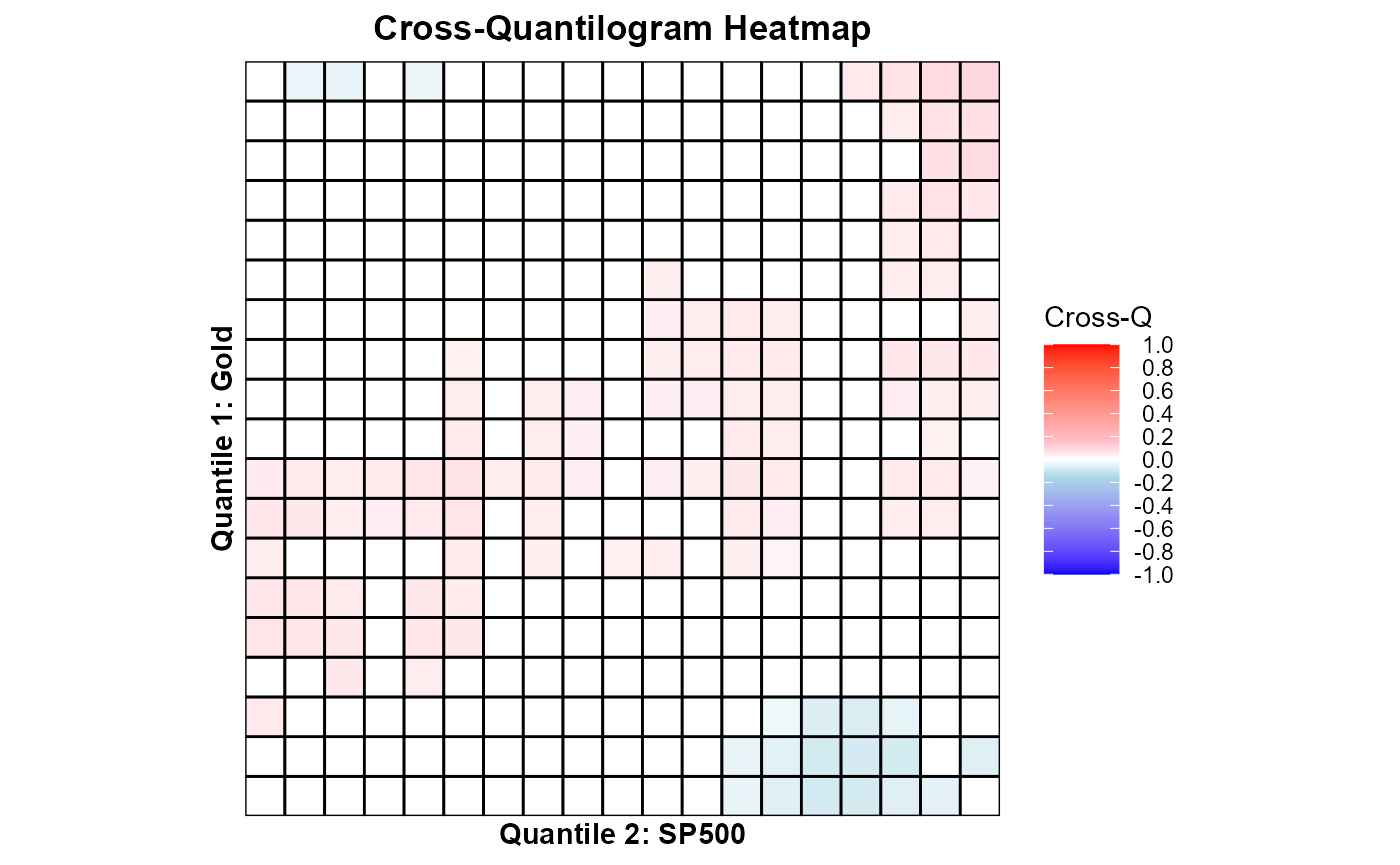

3️⃣ Cross-Quantile Dependence Heatmaps

## Install the 'quantilogram' library

# install.packages("quantilogram")

library(quantilogram)

# Use gold (GLD) as predicted variable, S&P (SP) as predicting variable

df1 <- hedgedata[, c("GLD", "SP")]

## setup and estimation

k = 1 ## lag order

vec.q = seq(0.05, 0.95, 0.05) ## a list of quantiles

B.size = 100 ## Repetition of bootstrap

res1 = crossq.heatmap(df1, k, vec.q, B.size, var1_name = "Gold", var2_name = "SP500")

## result

print(res1$plot)

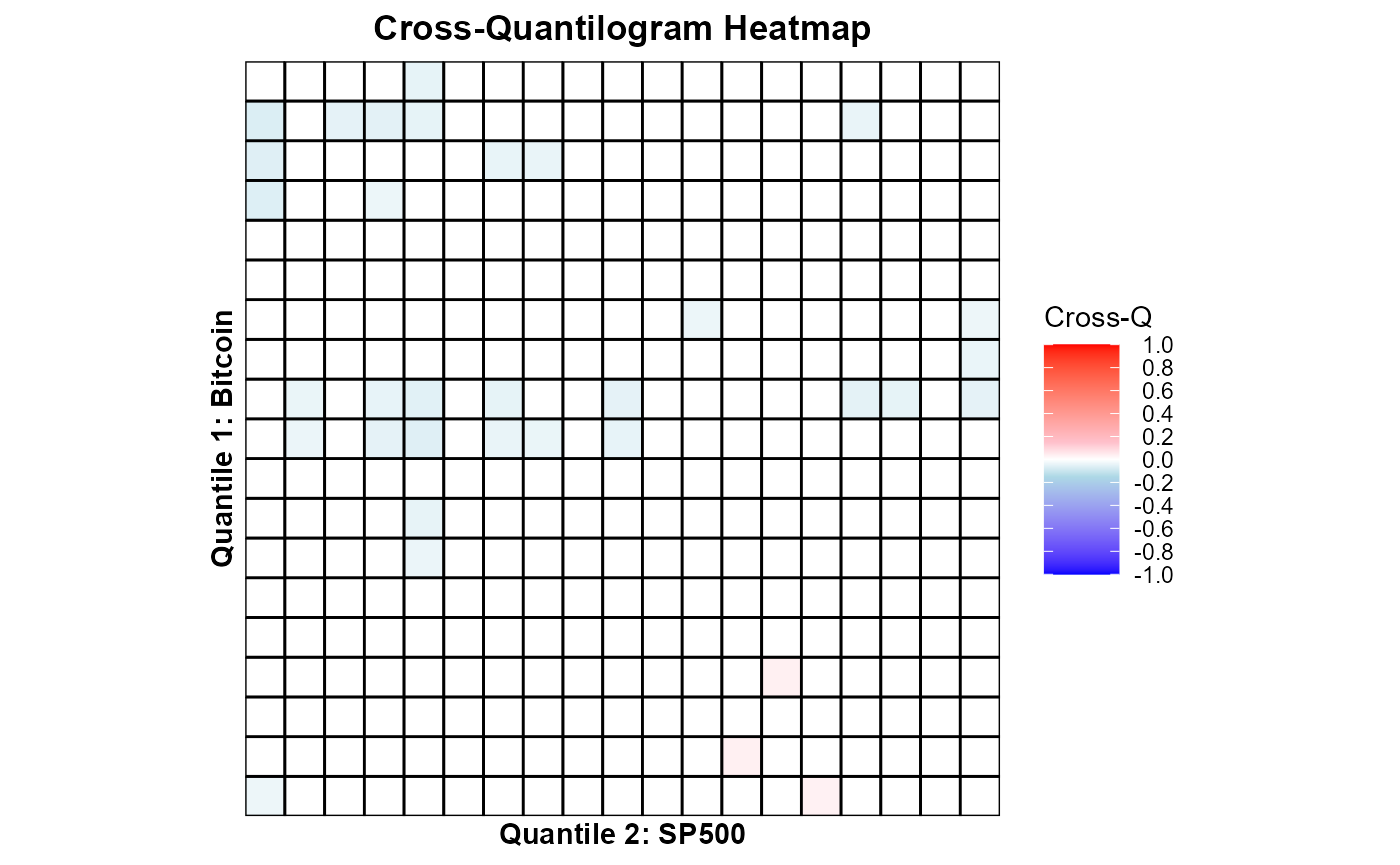

# Use bitcoin (BTC) as predicted variable, S&P (SP) as predicting variable

df2 <- hedgedata[, c("BTC", "SP")]

res2 = crossq.heatmap(df2, k, vec.q, B.size, var1_name = "Bitcoin", var2_name = "SP500")

## result

print(res2$plot)

These heatmaps visualize how dependence across quantiles changes from S&P 500 to gold and bitcoin — revealing whether gold/bitcoin remains uncorrelated or negatively correlated (safe haven) during market stress.

4️⃣ Conditional Diversification Benefit (CDB)

# Compute CDB for SP500–Gold portfolio at 5% tail

res_cdb1 <- cdb(hedgedata$SP, hedgedata$GLD, p = 0.05, w = 0.10)

print(res_cdb1)## [1] 0.3747956

# Compute CDB for SP500–Bitcoin portfolio at 5% tail

res_cdb2 <- cdb(hedgedata$SP, hedgedata$BTC, p = 0.05, w = 0.10)

print(res_cdb2)## [1] 0.1352266This returns CDB values for given portfolio weights in the hedging asset (gold/bitcoin). Higher CDB values imply stronger diversification benefits.