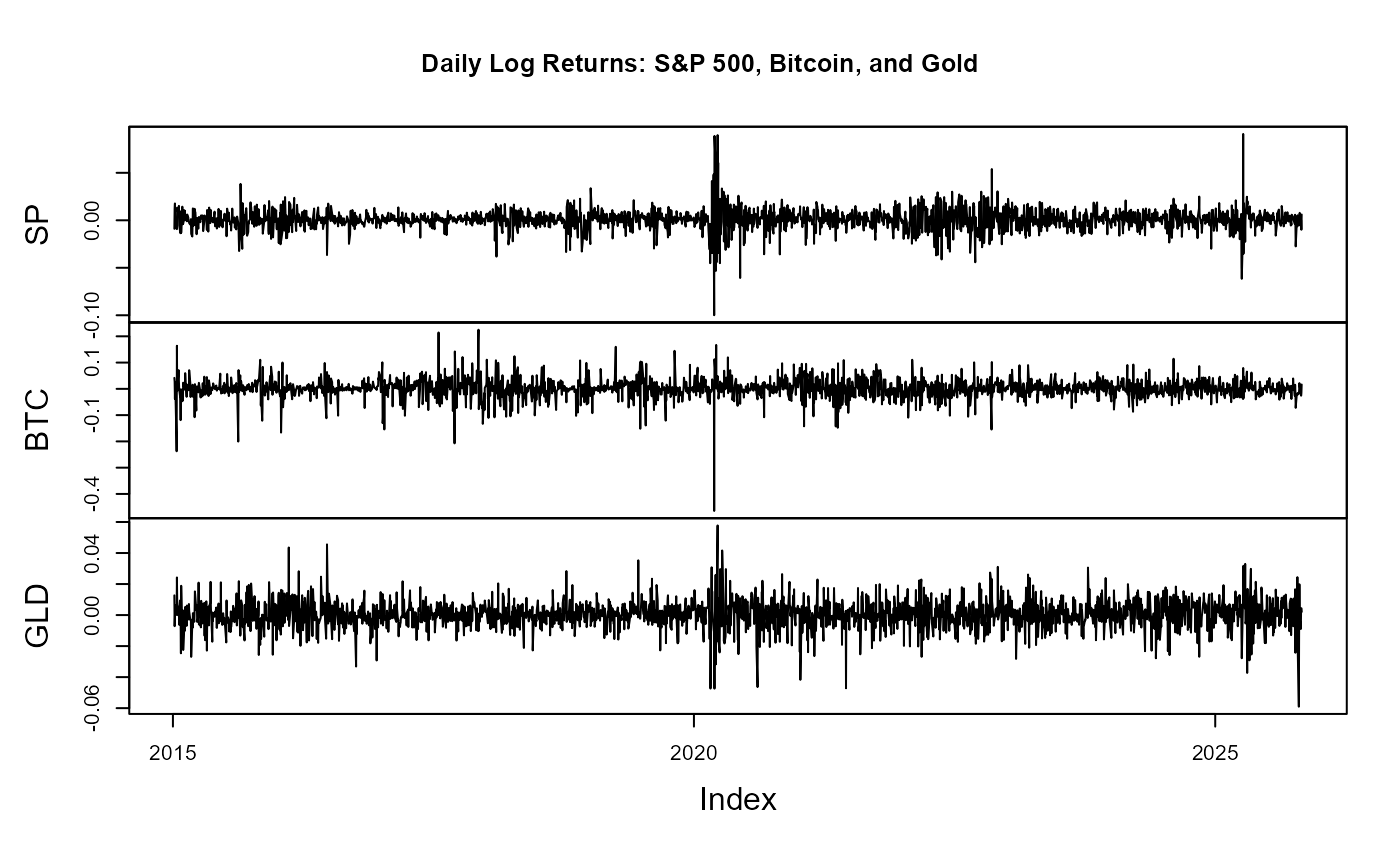

Daily log returns for S&P 500, Bitcoin, and Gold

hedgedata.Rdhedgedata provides daily log returns for three major financial assets:

S&P 500 (SP), Bitcoin (BTC), and Gold (GLD), obtained from Yahoo Finance.

The data are stored as a wide-format zoo object with a Date index.

Format

A zoo object indexed by Date with 3 numeric columns:

- SP

Daily log return of the S\(\&\)P 500 index (Yahoo symbol

^GSPC).- BTC

Daily log return of Bitcoin priced in USD (Yahoo symbol

BTC-USD).- GLD

Daily log return of Gold (front-month futures, Yahoo symbol

GC=F).

Details

Data construction process

The dataset was created using the following R workflow:

library(quantmod)

library(zoo)

symbols <- c("^GSPC", "BTC-USD", "GC=F")

names_vec <- c("SP", "BTC", "GLD")

from <- as.Date("2015-01-01")

to <- Sys.Date()

# Download daily closing prices

get_close <- function(sym, from, to) {

x <- getSymbols(sym, src = "yahoo", from = from, to = to, auto.assign = FALSE)

Cl(x)

}

prices <- do.call(merge, lapply(symbols, get_close, from = from, to = to))

colnames(prices) <- names_vec

# Compute daily log returns

hedgedata <- diff(log(prices))

hedgedata <- na.omit(hedgedata)

# Save into package

usethis::use_data(hedgedata, overwrite = TRUE)Log returns are computed as \(\log(P_t / P_{t-1})\).

Data are daily and aligned by calendar date.

Missing values (due to non-trading days) are left as

NAbeforena.omit().

Examples

data(hedgedata)

head(hedgedata)

#> SP BTC GLD

#> 2015-01-06 -0.008933255 0.04179588 1.271066e-02

#> 2015-01-07 0.011562736 0.02807297 -7.160879e-03

#> 2015-01-08 0.017730168 -0.03804604 -1.818894e-03

#> 2015-01-09 -0.008439322 0.02460744 6.269593e-03

#> 2015-01-13 -0.002581885 -0.17030573 1.297201e-03

#> 2015-01-14 -0.005830029 -0.23755772 8.099452e-05

# Plot all assets' log returns

plot(hedgedata, main = "Daily Log Returns: S&P 500, Bitcoin, and Gold")